Benchmarking Blockchain in Energy and Utilities - A Bellwether for 2018

In order to assess the progress that blockchain has made in the energy and utilities industry to-date and to forecast activity for 2018 a useful data point is to examine what is happening across other industries. By looking at industries such as financial services, healthcare and consumer goods we can perhaps see what less risk adverse and more consumer facing industries are experiencing in terms of activity. In order to do this, we examined three primary domains — number of startups, industry engagement and volume of consortia to build a picture of the relative activity of the burgeoning technology in energy. Indeed, since launching our blockchain resource center for utilities 18 months ago, we have witnessed a marked increase of publicity (and not necessarily market activity) across the space. One truth that is becoming increasingly clear across all sectors however, is that we are seeing an increasingly complex market evolve that is characterized by fragmentation — with dozens of competing protocol frameworks and hundreds of isolated, small-scale networks that are primarily used for testing purposes in play, and that is no different in the energy sector.

Startups and ICO Activity

Last month CB Insights found that year-to-date, ICOs (“initial coin offerings”) have raised more than $1.6B and identified 135 blockchain startups that have closed ICO’s greater than $500K since 2014. While their analysis doesn’t include categorizing blockchain activity in the energy sector, by using the latest data from recent energy related ICOs we can see where the industry falls. In the table below, we see that activity in energy and utilities is just starting to emerge in this space.

Source: CB Insights / Indigo 2017

Indeed, at this stage six energy-focused blockchain firms across North America, Europe, Australia and Asia are on pace to exceed $200M in token sale proceeds by the end of 2017, a review by S&P Global Market Intelligence found. With this in mind, and expanding on this analysis in the below table, we highlight 15 energy and utility related ICOs that have occurred or will occur in the near term in the industry.

Source: Indigo 2017

While skepticism surrounds ICOs in general and while very often these startups are pre-product and pre-development with only a whitepaper to attract unaccredited investors, what is interesting in the energy space is that a new form of financing may emerge. It is well noted that after electricity markets were restructured in the US R&D investment declined by nearly 74%. While investment has slightly rebounded and we are seeing utilities up their activity at the edge of the grid as we explained last year, this new form of financing may help startups tackle the complexity and long sale cycles that mar new entrants to the industry. From an ICO perspective however, the vast majority of energy startups at this stage are focusing on very similar solutions — building decentralized energy marketplaces. While many of these startups in all likelihood won’t succeed, it will be interesting to see what applications gain traction in 2018 and how governance of these startups will emerge.

In contrast to the large sums raised by some of these ICO’s, traditional blockchain venture financing sees an average of $3M for early-stage deals (seed / angel or Series A) according to CB Insights. In addition, aside from the startups on the list above, we are seeing a healthy market emerge including new companies such as Verv and Energy Bazaar as well as others featured in our blockchain in energy taxonomy.

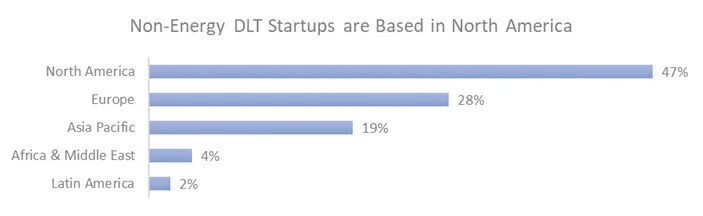

Taking a cross industry perspective again and using data from a recent University of Cambridge Global Blockchain Study which notes that the vast majority of blockchain startups are located in the US, the energy and utilities industry certainly bucks this trend. Our research shows us that the cross-industry numbers highlighted in the table below have energy related blockchain startups in North America at approximately 20% comparatively, with over 50% of startup activity occurring within the EU. The study also notes that the number of enterprise Distributed Ledger Technologies (DLT) startups has significantly increased since 2014, from approximately 37 companies to over 115 in 2017 with the number of full-time employees working at enterprise DLT startups ranging from a single employee to over 120. This holds true in the energy industry where we see many similar stakeholders working across multiple energy initiatives.

Source: University of Cambridge / Indigo 2017

This spread of activity is evidenced visually in our interactive map that shows the spread of ICOs and energy related blockchain projects globally below. In the past 2 quarters, the EU has continued to see a gradual increase in experimentation, with new projects and startups also emerging in in Asia.

Takeaway: In the last 2 quarters we have begun to see the ICO trend emerge in the energy sector. We expect to see this continue into 2018 and cool off in line with other sectors as skepticism amounts. For those companies that have raised significant capital, it will be interesting to see what impacts they can have in 2018 and in the short-term given the traditional poor performance of startups in this space. Additionally, we expect to see an uptick of activity in the US next year in the industry given the relatively low count of blockchain startups focused on energy.

Industry Engagement

Much has been said of the hype of blockchain across various industries. Across sectors where there is a more mature (yet still evolving) understanding of the technology there is a realization that while blockchain may be essential for some projects, using them for others is a costly mistake. As improved technical and functional requirements analysis emerge, it is clear that very often existing relational databases and other technologies solve business problems and serve business opportunities far better. Indeed, as trial and error continues in this space, Gartner believes that success in the early years of blockchain projects will be limited, with PoC maintenance rates over a two-year period at less than 12%. With that said, we are seeing two data points emerge here that point to relative levels of industry engagement. Firstly, the number of use cases identified by sector provides engagement and applicability insight and secondly, where blockchain providers are targeting customers provides opportunity insight. These two data points usefully depict where effort concentration is currently happening. The graph below highlights the number of identified DLT use cases by industry group. The data is based on a list of 132 use cases, grouped into industry segments, that have been frequently mentioned in public discussions, reports, and press releases.

Source: University of Cambridge / Indigo 2017

While the number of above use cases for energy may seem low, particularly when the German Energy Agency, dena, identified more than 110 use cases last year, and in many workshops energy companies have identified well over 50, the data presents that relatively speaking there is more activity in other industries. Often the inflated number of use cases identified arises when improper screening criteria is applied and other solutions are not examined first. With that said, in 2018 we expect to see opportunities arise where there are process efficiencies to be had with consortium blockchains in wholesale market trading and demand response, EV infrastructure / EV Roaming applications, trading of renewable credits, cybersecurity and new business models in P2P trading. These applications will certainly move the relative percentage highlighted above closer to the healthcare sector.

Secondly, in this space, and as the graph below depicts, we see another data point that confirms the use case estimate — financial services, payments, and banking services are the most frequently targeted sectors by blockchain providers (according to study participants). Importantly for energy although much focus is still put on monetary use cases, an increasing interest in nonmonetary use cases and applications can be observed (e.g., identity, supply chain).

Source: University of Cambridge / Indigo 2017

Takeaway: We are still at the very early stages of use case identification across all sectors, however, providers are still very much focused on financial services, payments, and banking services. In 2018 we expect to see further focus on blockchain use cases in the areas of provenance, new business models and EV charging and an improvement on how functional and technical requirements are conducted.

Blockchain Consortia by Industry

Critical to the implementation of blockchain and other DLT technologies in any industry is the formation of industry consortia. As blockchain is a network effect and exponential technology, it benefits from the participation of competitors, industry stakeholders and consumers. With this in mind, bringing these parties together to find equitable solutions is key. Recently, Deloitte researched that over 40 blockchain consortia have been formed globally with the majority of activity occurring in the financial services sector. In the figure below, comparing consortia formation in the Energy & Utilities sector with other industries we see very little activity.

While the graph above only includes the activity of the Energy Web Foundation, who have recently released a test network as they build out their public, permissioned, proof of authority blockchain, we also see use case specific consortia in the industry emerge such as the notable activity of PONTON’s Enerchain initiative. Indeed this month saw the first wholesale P2P trades take place between Wien Energie and Neas as they executed a day-ahead gas trade, and between Enel and E.ON as they executed a day-ahead power trade. With all that said, there is a clear need in the industry to form more regional consortium, and in line with current jurisdictions. Blockchain will emerge incrementally in the industry and by examining its potential under current market structures we will see higher engagement among utilities. These consortia should also be joined by regulators and system operators to ensure holistic participation and solution identification. For example, in Spain we recently saw the emergence of the world's first national multi-sector DLT (semi-public blockchain) consortium made up of about 70 of the largest companies and institutions in different sectors including utilities Endesa, GNF Prensa, Iberdrola & Viesgo among others. While some consortia in financial services have moved away from blockchain solutions, such as R3’s Corda platform, the value to be had from a collaborative exercise of examining share infrastructure provides a worthwhile business case in itself. Finally, in this space, 2018 is the year for standards groups to begin to look at this technology before divergent paths emerge. At the height of the smart grid market as many as 400 different standards existed which created many architectural and interoperability issues.

Takeaway: While we have seen the emergence of some industry collaboration around use cases and specific platforms, more activity is warranted in this space and along regional lines. These efforts will help the industry as a whole move forward in a more collaborative path. Overall, these forums will provide utilities a low-risk means to keep abreast of trends, competition and aid in their own implementation level efforts.

Looking to 2018

Most of the blockchain activity in 2016 and 2017 has focused on education, infrastructure development, PoCs and at least one production level solution. The ICO trend has given rise to plenty of out-bound marketing in recent months and we expect this to continue and gain the attention of more industry professionals. While there is a greater vision among some in this space of developing an entirely new energy operating system, change will be incremental and as such activities will need to follow this path. Given the comparison and benchmark to other industries highlighted in this piece, some key areas that we are expecting to see evolve in 2018 include:

- Service providers will continue to focus on core infrastructure such as protocol development and network development, however, much more time will be focused on actual application development to make use cases real for the sector

- Further sophistication in architecture will emerge particularly around considerations such as reducing data stored on-chain and support for multiple consensus algorithms (‘pluggable consensus’)

- The debate between open (public permissionless, public permissioned) and closed (consortium, private permissioned / enterprise) blockchains will continue with an emphasis on more blockchain interoperability

- On the regulatory front we are expecting to see lessons learned from the ‘regulatory sandboxes’ that have been created by Ofgem in the UK and by Singapore’s EMA

- There will be more maturity around functional and technical requirements and further scrutiny between using relational databases and other solutions and true blockchain solutions

- With regards to use cases, we expect to see much more focused activity in the areas of consortium blockchains in wholesale market trading and demand response, EV infrastructure / EV Roaming applications, trading of renewable credits, cybersecurity and new business models in P2P trading

- The idea of convergence solutions will also start to take hold where blockchain, robotics and AI solutions will combine with OEMs, DER manufactures, infrastructure providers and existing applications to further innovate energy platforms of the future

- Finally, we expect to see much more activity in the US next year and rise of further geographic consortia emerge

We are at the start of this market. Next year as the hype cools off, the hope is that business cases, organizational value and the translation of whitepapers and experiments turn into real world applications. Blockchain may be one piece of the energy transition puzzle, it’s a multi-decade journey, but we are on our way.

AI, blockchain and robotics are part of Indigo's, emerging technology offering for utilities, for more, see our practice areas.